Trading Floor Business Continuity Strategies Will Require Investments Beyond Resiliency and Redundancy

By Ryann Menges, PE

By Ryann Menges, PE

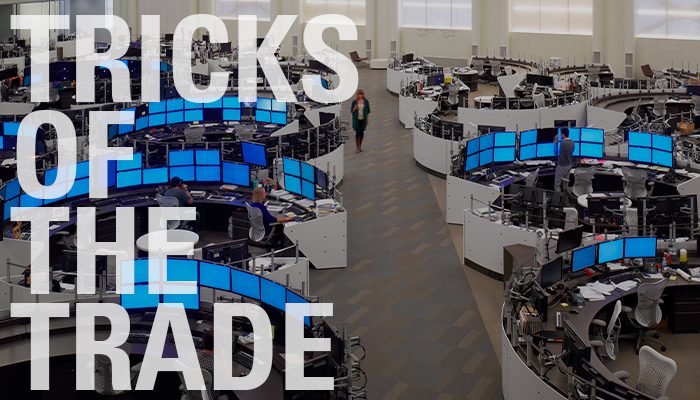

When markets are volatile, traders want to be in on the action! And for the traders who do not have the option to easily work from home, their health is important to the success of the firm.

The Wall Street Journal recently published a story about how coronavirus swept through a financial firm’s trading floor while the company traded more shares in one day – as the virus was breaking out – than any day in their history. Trading floors require a high level of risk mitigation, and leaders within these financial companies have developed comprehensive business continuity action plans to enable them to work through natural disasters and extraordinary circumstances.

Why do they invest so heavily in business continuity? The impact of an outage can devastate investors. In 2012, a software glitch resulted in a $461 million loss within 30 minutes for a high-tech financial company. Many lessons were shared across the industry and many of these companies adopted software development protocols to mitigate software glitch risks.

Traditionally, high-tech financial firm leaders focused on highly redundant and resilient infrastructure to overcome disruptions due to utility power outages, equipment failure, security breaches and in extreme circumstances – terrorist attacks and natural disasters – to keep their trading floors productive on a 24/7 basis. Global pandemics and stay-at-home governance have not traditionally been on the list of business continuity considerations.

It is anticipated that there will be a higher percentage of people working remotely/working from home after the pandemic has subsided. A recent article in the New York Times shared the following statistic from Kate Lister, president of Global Workplace Analytics, who expects more than 25 percent of employees to continue working from home multiple days a week, up from fewer than 4 percent who did so before the pandemic. Leaders of companies across multiple industries have expressed a genuine surprise for how their business is able to maintain continuity and operate efficiently while their people are working productively, remotely.

There are unique considerations for trading firms though, namely regulatory restrictions, latency issues and reduced technology resources. Though technology is evolving and the trader workstation configurations are adapting – e.g., virtual desktops in lieu of CPUs – home offices typically lack the speed, power and multi-monitor configurations offered within a trading floor workplace.

From an engineering and infrastructure perspective, there will be further review of the distribution of critical infrastructure to build in additional flexibility needed to support new concepts related to trader density and co-worker adjacencies. As we design trading floors and the discrete critical rooms on these floors, we analyze the need for equipment redundancy and power and technology pathway redundancy. The most robust designs also place an emphasis on physical diversity. The principle of physical diversity will now be reviewed and applied to trader workstations.

Physical separation, along with maintenance and other environmental best practices, will be key in maintaining the continuity of operation during and post pandemics. Decision makers at these firms are now evaluating additional business continuity strategies for protecting their workforce and establishing an infrastructure design that weighs the cost implications of increased infrastructure installation versus disruption to business operation.

The built environment is under a magnifying glass right now. Questions are being asked about modifications we can make to the heating, ventilating and air conditioning systems to help mitigate the impact of a pandemic. Real estate owners and operators are asking about the benefits of greater levels of filtration, increased outside air intake and implementing active humidification. Although there isn’t enough information on the COVID-19 virus to give scientific answers for a solution, now is the time to foster deeper conversations about wellness in buildings – increased air quality and overall impact to buildings people want to be in.

Key Considerations for Trading Floors Post-pandemic:

Reach out to Ryann to continue the conversation to enhance your business continuity plans.

Interested in learning more? Check out these related news items.

The evolution of the modern office needs to accommodate team members meeting in person and online. ESD now Stantec Senior Audio Visual Consultant John Doyle offers an overview of the best technology to consider. (Learn more about the meeting room technology.)

New technologies are transforming the traditional workspace allowing building owners, operators, and developers to attract and retain tenants in a competitive market. (Learn more about the smart building technology.)

Two of the largest expenses for law firms are real estate and technology. ESD, now Stantec Practice Leader for Technology Mo Fahim says higher-end spaces may have an advantage because they support new technologies better. (Read Mo’s interview at Law.com.)